Mark Twain famously lamented, “lies, damn lies, and statistics”. Perhaps today his lament would be, “Wall street charts and graphs”?

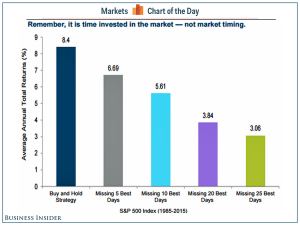

Twain’s quote comes to mind whenever the “Best Days Chart” appears in the financial media as support for a “buy and hold” strategy. The typical version illustrates what would happen if an investor misses just a few of the market’s “Best Days” because they were out of the market:

Market volatility is considerably higher during bear/down markets than bull/up markets. Over 70% of Best AND Worst Days occur during bear markets. While buying and holding guarantees being around for the Best Days, it likewise ensures being present for any corresponding Worst Days, too.

Since 1/1/2000 the five Best and five Worst Days are clustered together within a roughly six month period, from 9/29/2008 to 3/23/2009, also known as the tailend of the 2008/9 financial crisis/recession . The Best Days averaged an +8.6% gain while the Worst averaged an -8.2% loss, resulting in a negative return. The math is not intuitive but it becomes easier to see if one considers an extreme example in which it takes a 100% gain to make up for a 50% loss.

In this specific case, using a $100,000 investment, an 8.6% gain on one day followed by an 8.2% loss the next day would read $100,000 + [$100,000 x .086] – [$108,600 x .082] = $99,695. If the five Best Days and Worst Days are linked sequentially, the result is a bit worse, at $98,109. An investor that checked out for all seven months during which the five Best and Worst Days occurrred (9/1/08 to 3/31/09) would have avoided an over 35% loss! Indeed, it would clearly have been better to miss both the Best and Worst Days.

Ned’s Note’s Takeaway: The statistics behind the ‘Best Days’ charts are misleading and, in fact, dangerous unless they also account for a reasonable assumption about offsetting ‘Worst Days’. The track records of disciplined investors following well-conceived strategies amply demonstrate that it is possible to miss a sufficient combination of good and bad days to beat a pure buy and hold by a sound margin.